As a small business, you have many challenges you face every

day. Not only is your time spread thin, your dollars are stretched tighter than

pantyhose on Miss Piggy. And you still have to work on your business while

you are working in your business.

Here is an important quote from Henry Ford.

“A man who stops advertising to save money

is like a man who stops a clock to save time.”

Even with

everything else you have going on in your business, you must make the time and

the investment to market your business. For small businesses, social media is

an excellent way to continue to market your business without a large investment

of money. But it does take time, and you have to start somewhere. So how do you

navigate the many different social media opportunities available to you?

To help cut through

some of the clutter, this will be the first in a series of articles on Social

Media for Small Business. We will start with the top seven social media sites that are

appropriate for small business – Facebook, Instagram, Google+, LinkedIn,

Pinterest, Twitter and YouTube.

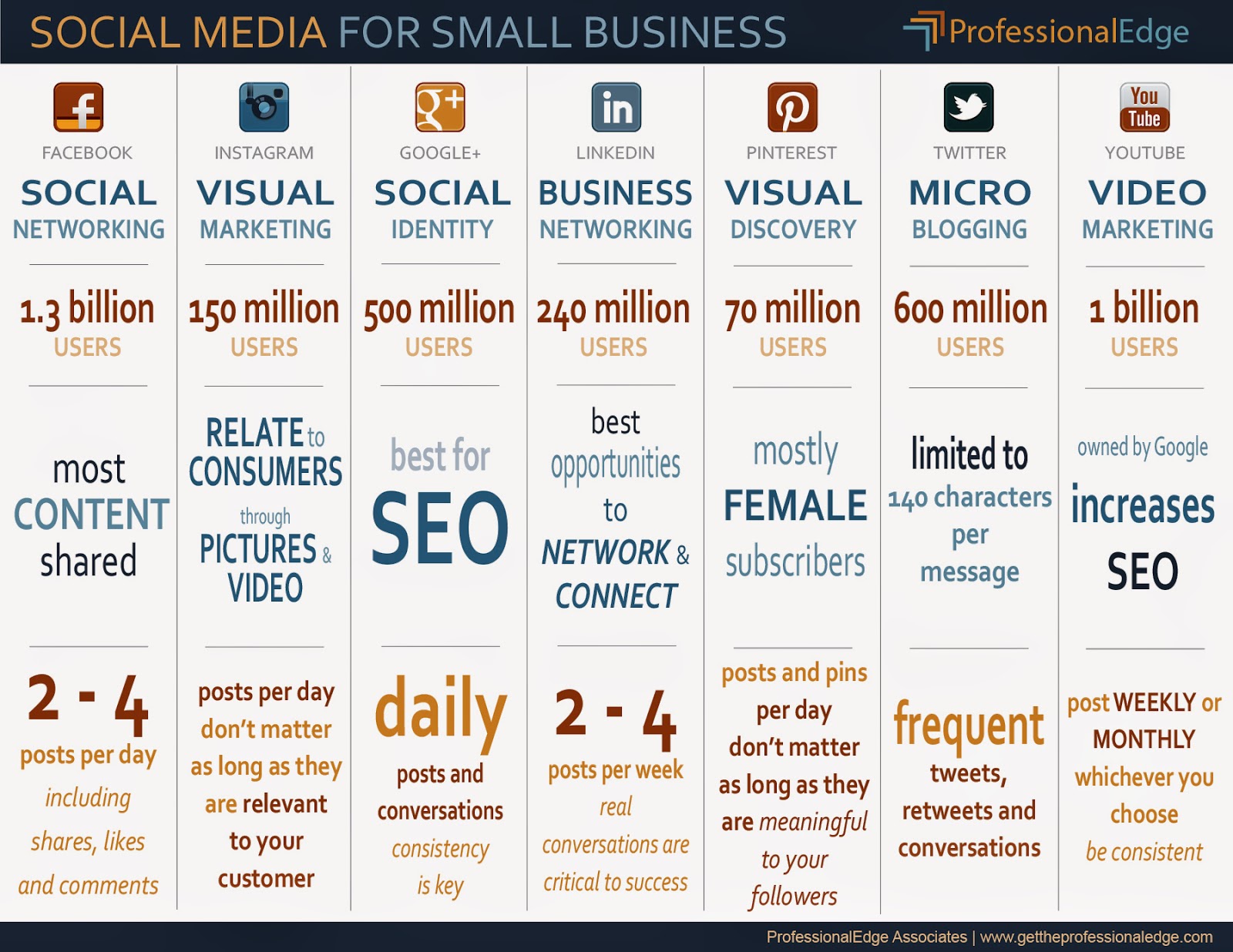

To aid

in breaking down the overwhelming amount of information, we've created an

infographic that illustrates the most useful information about each of these

sites. Click on the graphic to open a larger version in a new window.

In

this article, we will focus on how to determine which social media

opportunities will work best for your business.

Let’s

start with what each of these sites can do for you.

Facebook is a social

networking site with 1.3 billion users and growing rapidly. Because of this

high number of users, it is where the highest amount of content is shared.

Facebook is a medium for businesses who want to connect with individuals

or other small businesses. It’s a great place to post important information

about your business and to have conversations with customers and potential

customers about how you can meet their needs.

Instagram is a visual

marketing site with 150 million users. It allows you to relate to consumers

through pictures and video. Instagram is a medium used by photographers

and videographers to showcase their talents and could also be a good way for

small boutiques, fashion designers or similar small businesses to post photos of their merchandise.

Google+ is a social networking

and identity site with 500 million users. Google+ is similar in a lot of ways

to other social networking sites, so you may think it is redundant. But

consider that is owned by Google, one of the largest search engines in the world,

so every time you post on Google+ it increases your SEO (search engine

optimization). Google+ also

includes an authorship tool that associates web-content directly with its

owner/author.

LinkedIn is a business networking site with 240

million users. It offers opportunities to network and connect with business

associates and potential business customers. It is best used to make and

cultivate connections for your business.

Pinterest is a visual discovery site with 70 million

users, the majority of whom are female. This site allows you to post or pin

pictures of things you like or want to share and to connect with others through

their pins and posts. Pinterest is a tool to enhance your other social

networking by sharing pins and posts on other sites. Small businesses who want

to share photos of their merchandise, recipes or items in a portfolio should

consider adding Pinterest to the mix.

Twitter is a micro blogging site with 600 million

users. Each post is limited to 140 characters and can now also include a

graphic or photo. Twitter is used primarily to share real-time information

about what is going on in your business. It is a tool for on-the-spot

communication about events, sales and other promotions and can also be used to

share blog posts and other important information about your business. Twitter

takes an investment of time overall, but there are many tools available to

help you schedule and plan posts in advance. We’ll talk about them in more

detail in a future article in this series.

YouTube is a video marketing tool with 1 billion

unique users each month. It is owned by Google so it also helps increase SEO. YouTube provides and opportunity for businesses to share how-to’s, training and other

informational videos about your business that can be added to posts in other

mediums to increase visibility. Creating videos doesn't have to be expensive

and can be done on most laptops or tablets now with only an investment of time.

They should be considered as an add-on to any small business marketing strategy.

That is each of

the top 7 social media opportunities in a nutshell. There are of course many

other ways for businesses to use each of these sites. Please comment below to share how

you are using these or other sites or how you want to incorporate them into

your small business marketing strategy.

Please take a

moment to share our blog with your colleagues and friends who you think may

benefit. The next article will dive further into each of these sites and talk

about good posting strategies to enhance your social media effectiveness.

.jpg)